SMT

PersonalFinance

Company Earnings

Understanding Corporate Performance: Insights from Company Earnings Across Industries

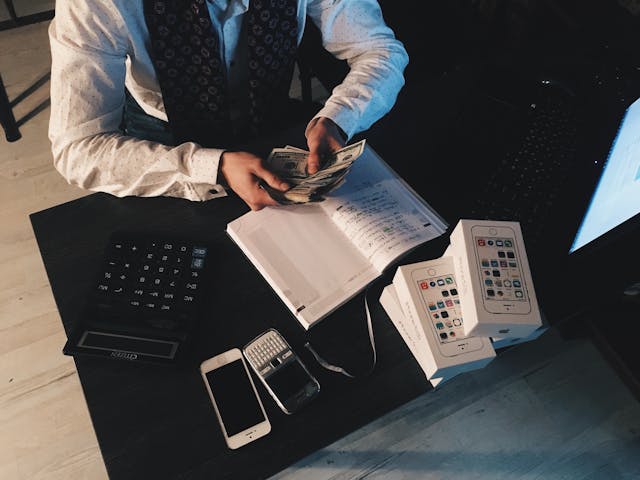

Earnings season is a pivotal time for investors and financial markets alike, offering a window into the financial health and performance of companies across various sectors. These quarterly or annual reports provide insights into key metrics such as revenue, net income, earnings per share (EPS), and operational expenses. Understanding these figures is crucial for stakeholders as they assess the profitability, growth prospects, and strategic direction of businesses.

In the technology sector, companies like Apple, Microsoft, and Alphabet often dominate headlines with their robust earnings reports. These tech giants showcase substantial revenue growth driven by innovations in cloud computing, artificial intelligence (AI), and digital services. Their earnings announcements not only highlight financial achievements but also serve as barometers for technological trends shaping global markets.

Healthcare companies, including pharmaceutical firms and biotechnology pioneers, disclose earnings that reflect their investments in research and development (R&D) and advancements in medical treatments. Earnings reports from industry leaders like Pfizer and Johnson & Johnson provide insights into pharmaceutical sales, clinical trial outcomes, and regulatory milestones, influencing investor confidence and market sentiment.

Energy sector earnings are heavily influenced by commodity prices, global demand for energy, and investments in sustainable practices. Companies involved in oil and gas production, as well as renewable energy initiatives, disclose financial results that detail operational efficiencies, exploration activities, and environmental initiatives. Earnings disclosures from firms such as ExxonMobil and NextEra Energy illuminate trends in energy consumption and production methods.

Financial services firms report on their lending activities, asset management services, and investment banking revenues. Earnings releases from banks like JPMorgan Chase and Goldman Sachs provide insights into loan performance, interest rate trends, and regulatory compliance efforts. These reports are essential for assessing the resilience of financial institutions amid economic fluctuations and regulatory changes.

Consumer goods companies navigate shifting consumer preferences and market dynamics through their earnings disclosures. Reports from companies such as Procter & Gamble and Unilever detail product innovation strategies, marketing initiatives, and regional sales performance. These insights inform stakeholders about brand resilience, market competitiveness, and consumer spending patterns.

Telecommunications companies disclose earnings that highlight network infrastructure investments, subscriber growth, and digital transformation initiatives. Leaders in the telecom sector, including Verizon and AT&T, report on 5G network expansion, broadband connectivity, and digital services adoption. Their financial disclosures underscore efforts to enhance network reliability, speed, and coverage amid evolving customer demands.

Automotive industry earnings reflect investments in electric vehicles (EVs), autonomous driving technologies, and sustainable mobility solutions. Companies like Tesla and Toyota disclose financial results that outline EV production targets, battery technology advancements, and global sales performance. These reports offer insights into the industry's transition towards cleaner transportation solutions and technological innovations.

In conclusion, company earnings reports serve as critical tools for investors, analysts, and stakeholders seeking to understand corporate performance and industry trends. These disclosures provide transparency into financial results, strategic initiatives, and competitive positioning, guiding decision-making processes in a dynamic global economy. As companies continue to navigate market uncertainties and capitalize on growth opportunities, earnings reports remain indispensable in assessing business resilience and long-term sustainability.